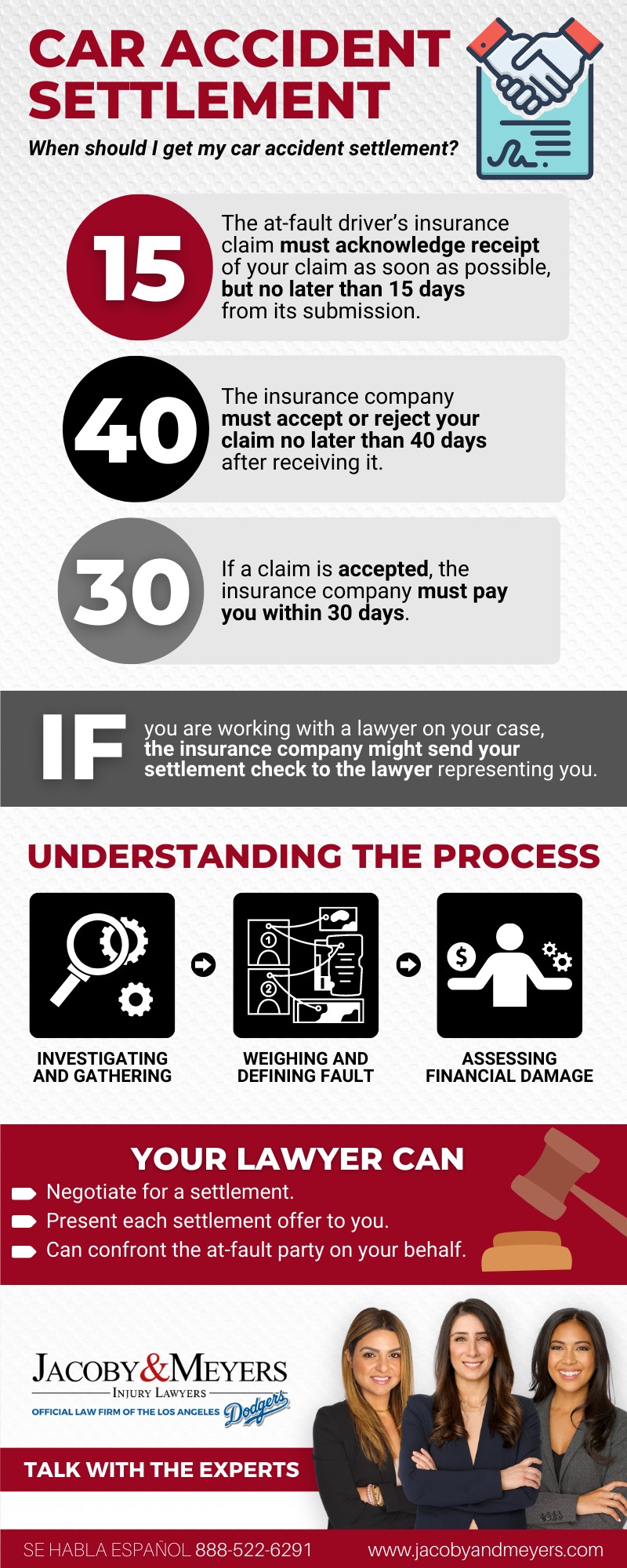

According to California Department of Insurance regulations, after you are involved in a Los Angeles car accident, how long the insurance company has to pay a settlement claim is outlined by the state’s Fair Claims Settlement Practices Regulations guidelines. It requires the at-fault driver’s insurance provider to adhere to the following timeline:

- The insurance company needs to acknowledge receipt of your claim, start investigating it, supply you with insurance forms, and reply to your attempts at communication within 15 days.

- They also need to accept or deny your right to file a claim or provide you with a fair and reasonable settlement offer within 40 days.

- Finally, the insurance company is required to make the payment for your final settlement agreement within 30 days.

You and your personal injury team might also impact the timeline. This includes the duration between receipt of an initial offer and settlement of an agreed-upon claim. Your legal team may be able to help you ensure the at-fault driver complies with the state-mandated timeline. However, you will decide to accept or reject a settlement.

Listening to your lawyer’s advice and weighing each offer you receive may lengthen the time that elapses between the beginning of settlement negotiations and the finalization and payment of your claim.

A Speedy Settlement Is Not Always a Good One

Bills and expenses combined with the loss of income due to your injuries can prevent you from working. These factors can make your car accident’s financial aftermath a stressful and frustrating time. Mounting health care and property damage bills might make a speedy settlement offer seem tempting. Accepting a settlement offer might not always provide an acceptable resolution to your claim for the following reasons:

- It may take time for you or your legal team to receive the plethora of bills that stem from the car accident and typically come from more than one billing source.

- Accepting a settlement before the financial impact of the accident is clear might be financially risky.

- Once you accept a settlement offer, you may need to relieve the at-fault driver of any further financial liability.

- Even if you uncover additional valid accident-related damages, you might not be able to recover them after accepting and signing a settlement agreement.

The legal team who represents you may familiarize you with the details of accepting a settlement offer. They can also inform you on the timeline for receiving payment. Your legal team may also help you accurately value your compensation claim before the state of settlement negotiations.

Valuing Your Recoverable Damages in a Compensation Claim

Understanding the value of your compensation claim is the beginning of effective settlement negotiations. California Civil Code (CIV) §1431.2 may allow you to recoup the following recoverable damages:

- Physical pain and suffering

- Accident-related lost wages

- Accident-related health care

- Mental and emotional trauma

- Property damage or total loss

- In-home medical or household help

Carefully assessing your accident-related expenses and losses may help avoid undervaluing or underpaying your potential compensation package. Your legal team may be able to help gather the required documents. These documents can help lead to a precise calculation of your compensation claim.

The law firm representing you may also work hard to file your potential personal injury lawsuit on time. You and your legal team generally have two years from the date of a car accident to file a personal injury lawsuit, according to California Code of Civil Procedure (CCP) §335.1. If a family member suffers fatal injuries in the accident, you also have two years from the date of their death to file a wrongful death lawsuit.

Find Out How Long You Have to Wait for Financial Compensation

When the financial consequences of a car accident start to add up, you might find it hard to wait for settlement negotiations to end in an agreement. It might be even more difficult to wait for your agreed-upon claim to be paid by the at-fault driver’s insurer. Our legal team can help you understand how the financial settlement process works.

We might also be able to help you understand how long the insurance company has to pay your settlement claim and when you can expect to receive settlement funds. When you are ready to resolve your compensation claim, our team is ready to help you reach a favorable financial settlement. Reach out to Jacoby & Meyers Law Offices by calling (866) 559-7223 today.

[INFOGRAPHIC] When Will I Start Getting Paid from my Car Accident Settlement

Call or text 866-559-7223 or complete a Free Case Evaluation form